International Money Transfers

How to make an international money transfer? Costs, times and requirements

Learn how to make an international money transfer.

8 min read

22 Aug 2024

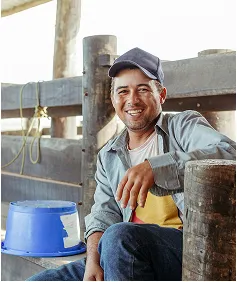

For immigrants in the United States, sending money to their home countries regularly is essential. Therefore, it is important to have access to affordable and accessible financial services.

If you want to know how to make an international money transfer, it is crucial to first compare the different providers of this service and choose the one that offers the most advantages for you and your family.

Comun stands out as a popular option among immigrants because it allows them to send money abroad from the United States, offering advantages in terms of cost, speed, and other key factors.

Below, we provide a comparison table that includes Comun and traditional financial institutions in the United States, such as Bank of America and Wells Fargo:

| Comun | Traditional Financial Institutions | |

|---|---|---|

| Fee | Transfer fee starting at 2.99 USD up to applicable limits | From 10 to 45 USD, depending on the bank |

| Intermediary fees | $0 USD | May generate extra fees from intermediary banks |

| Exchange rate | Competitive | Higher margin than official |

| Speed | Instant to a few minutes (average 8) | From 1 to 5 business days |

| Estimated total fee | 2.99 USD transfer fee + exchange rate, with no extra charges (The first transfer has no fee. Subsequent transfers have a fee starting at $2.99 USD, up to the applicable limit. ATM or intermediary charges may apply; check the app for more details). | From 20 to 60 USD, due to fees and less favorable exchange rates |

How Does an International Money Transfer Work?

The first point to understand is the types of bank transfers available, as this determines the final cost of sending an international money transfer.

In the United States, there are two types of international money transfers: through traditional banks or through specialized services for sending money abroad.

International Money Transfers via Traditional Banks

- Supported by official U.S. financial institutions and security measures, including:

- Identity verification (KYC/CIP) and ongoing AML monitoring (BSA).

- OFAC sanctions screening for senders and recipients.

- Consumer protections for remittances under Regulation E (pre-transfer disclosures, cancellation rights, and error resolution).

- Network and messaging security standards (e.g., SWIFT Customer Security Program).

- Multi-factor authentication and encryption for online banking access.

- A U.S. bank account is mandatory

- Operates through the SWIFT code

- Generates higher fees due to intermediaries

- Transfer time may take up to 5 business days

International Transfers via Specialized Applications

- Operates through digital networks connected with banks or physical branches in each recipient country

- Lower fees, as they do not use intermediaries and offer more competitive exchange rates

- Money transfers are completed within minutes or hours

- A U.S. bank account is not mandatory to use these services

Before paying unnecessary fees, make sure to choose the best international money transfer provider and make the most of your money.

Steps and Requirements for Making an International Money Transfer

Below, we outline what is needed to easily make an international bank transfer from the United States, whether you choose a traditional bank or a specialized application for this type of service:

1. Choose a Provider

Some of the traditional banks you can use are Chase, Bank of America, Capital Bank, Citibank, and Wells Fargo. If you don't have a US bank account, you'll need to make sure you have the necessary requirements to open an account, such as a Social Security Number (SSN). For the aforementioned banks, you can present an ITIN instead, along with a government-issued ID.

Another factor to consider is how long an international money transfer takes, as traditional banks usually take longer due to intermediaries involved in the process.

If you prefer a specialized application for international money transfers due to the flexibility they offer compared to banks, an excellent alternative is Comun, which allows you to transfer money from your phone without complications or intermediaries.

2. Create an Account

General Requirements for Opening an Account at a U.S. Bank

- Valid passport or immigration document

- Social Security Number (SSN)

- Individual Taxpayer Identification Number (ITIN)

- Proof of address in the United States

- Some banks require an initial deposit of approximately $25 USD

Depending on the bank, you may open the account online or by visiting a branch for data verification.

Requirements for Opening an Account with Comun

- Mobile phone compatible with Android or iOS

- Email address

- Official foreign identification

- Have a US residential address

In both cases, you will have access to a debit card and a mobile application that will allow you to make international money transfers and other transactions from the palm of your hand.

3. Enter Transaction Details

Once you activate your account, enter the information required for an international money transfer:

- Full name of your recipient, as it appears on their official ID

- Recipient’s phone number

- Recipient’s address (only if sending money to a bank account)

- Recipient’s account number (only if sending money to a bank account)

- SWIFT code (if transferring through a traditional bank)

Then, enter the amount you wish to send.

Comun and other specialized applications also allow cash pickup at physical locations, so your recipient does not need a bank account.

4. Review Costs and Rates

Next, review the international money transfer fees as well as the exchange rate, as these will impact the final amount your recipient receives.

The cost of an international money transfer depends on several factors, which we detail below.

5. Send the Money

Once you confirm that the information entered is correct, authorize the transfer, including any additional fees.

Comun allows you to track your transfers through its application, whether you choose to send money to a bank account or opt for cash pickup at a physical location.

Remember that transfer speed depends on the platform, and traditional banks can take up to 5 business days to complete these transactions.

6. Confirm Receipt

Finally, confirm with your recipient that the transfer was received within the stipulated timeframe. You can generate a transaction receipt directly in the mobile application.

Everything About the Cost of Sending Money Abroad from the U.S.

International money transfers are a common practice among immigrants in the United States.

That is why it is essential to detail the factors that influence the cost of transfers, as well as the best options for sending remittances to your family quickly and without complications.

These are the main factors to consider when calculating the cost of your international money transfers:

- Transfer Fees

International transfers incur a fee, which varies depending on the platform, whether it's a traditional bank or a specialized app.

Another factor that affects the fee level is the method used to send the money. The price can vary depending on whether the transaction is made through a website, an app, or at a physical branch.

International money transfer fees at traditional banks vary depending on the financial institution. Here are some examples:

- Bank of America: $45 USD

- Wells Fargo: from $25 to $40 USD

- Citibank: from $25 to $35 USD

- Truist Bank: $65 USD

On the other hand, some mobile applications offer international money transfer options for less than $3 USD, which is much more beneficial for the economy of foreign workers.

- Exchange Rate

The exchange rate also significantly impacts the final amount your recipient receives. It refers to the value applied by the platform when converting the dollar amount to the local currency.

Traditional banks generally use a lower rate than the official rate. For example, if the Mexican peso is officially 18.00, banks might apply approximately 17.20 MXN.

This means that if you send $300 USD, your recipient could receive about $13 less (240 MXN less), not counting the bank fees, which make the cost even higher.

- Hidden Fees

In addition to international money transfer fees, traditional banks may charge additional fees if intermediary banks are involved in processing the transfer.

We recommend checking all costs involved and choosing a competitive option that does not reduce the total amount your family will receive.

Comun is an excellent alternative for making international money transfers, as your first transfer fee is waived, and subsequent transfers have a fee starting at $2.99 USD per transfer, up to applicable limits, with no hidden fees or intermediaries.

Review our comparison table between traditional banks and Comun at the beginning of this article, and choose the best option for your money.

Want to Make Secure International Money Transfers? Do It Easily with Comun

In this article, we presented how to make an international money transfer from the United States through traditional banks or specialized applications such as Comun, an excellent choice for immigrants.

Comun is the solution for bringing immigrant families closer together through affordable and low-cost remittances.

Why Choose Comun for International Money Transfers?

- Easily open your account with official documentation from your country

- Send money to your family with a transfer fee starting at $2.99 USD, up to the applicable limits.

- Your money will arrive within minutes

- Access a mobile application and Visa debit card for better control of your finances

Discover an easy and fast way to access the financial services you deserve. Open your account with Comun and forget about complications.

Conclusion

Starting a business as an immigrant is entirely possible with the right steps. By choosing the right business structure, obtaining the necessary tax IDs, and registering properly, you’ll build a strong foundation for success.

Need an easy way to manage your business finances?

Común offers banking solutions designed for Latino entrepreneurs. Open your account today!

Olivia Rhye

Community Partner

Living in the United States

El Alto Costo de los Bancos Tradicionales y Estar Sin Banco en Estados Unidos

8 min de lectura

Hoy en día, muchos latinos que viven en Estados Unidos podrían estar pagando de más por servicios financieros. Según un informe de 2021 de la Corporación Federal de Seguros de Depósitos (FDIC), el 24.1% de los hogares hispanos tienen acceso limitado a servicios bancarios, lo que significa que el hogar tiene una cuenta corriente o de ahorros en una institución financiera pero ha utilizado otros servicios (por ejemplo, giros postales, transferencias de remesas, cobro de cheques) fuera de su banco o cooperativa de crédito. Acceder a servicios adicionales fuera de un banco puede ser costoso.

El informe de la FDIC también encontró que el 9.3% de los hogares hispanos no tienen acceso a servicios bancarios, lo que significa que nadie en el hogar tiene una cuenta corriente o de ahorros en una institución financiera. No tener acceso a servicios bancarios puede resultar en una limitación para acceder a ciertos productos y servicios financieros, como cuentas de ahorro que ofrecen oportunidades de inversión y opciones de seguros.

Para examinar el costo que los latinos podrían estar pagando para acceder a servicios financieros en Estados Unidos, Comun realizó un análisis comparando el costo si un individuo fuera cliente de Comun en comparación con una institución financiera tradicional. El estudio también examinó el costo de no tener acceso a servicios bancarios. Además, Comun analizó el costo de las tres opciones durante un año y cuánto podría ahorrar un individuo si utilizara un servicio como Comun durante un año y durante un período de cinco años.

| Tipos de servicios financieros | Comun | Banco Tradicional | No bancarizado |

|---|---|---|---|

| Apertura de cuenta* | $0 | $100* | $0 |

| Costo mensual | $0 | $144.00 | $0 |

| Tarifa por depósito en efectivo (ATM) | $42 | $60 | $0 |

| Tarifa de remesa | $66 | $1,080 | $184 |

| Cargo por sobregiro | $0 | $0 | $0 |

| Avanzar depósito directo | $0 | $0 | $0 |

| Tarifa de depósito de cheques | N / A | $0 | $96 |

| Tarifas de giro postal | N / A | N / A | $24 |

| Total | $108 | $1,284 | $304 |

*Nota: Comun no incluyó la tarifa de apertura de cuenta en el monto total para el banco tradicional, ya que asumimos que este usuario no mantendría los requisitos de saldo mínimo y, por lo tanto, incurriría en una tarifa mensual de $12.

Cuánto pueden ahorrar los clientes si utilizan un servicio como Comun en un año:

Costo de una cuenta bancaria tradicional: $1,176

El costo de no estar bancarizado: $196

Cuánto pueden ahorrar los clientes en cinco años si utilizan un servicio como Comun:

Costo de una cuenta bancaria tradicional: $5,881

El costo de estar sin banco: $981

Comentarios adicionales

Además de los costos directos como el cobro de cheques o las tarifas de giros postales, las personas no bancarizadas también incurren en muchos costos indirectos, como:

- Altos costos de endeudamiento: Sin una cuenta bancaria, acceder al crédito puede resultar más complicado y costoso. Las personas no bancarizadas pueden recurrir a servicios financieros alternativos, como préstamos de día de pago o casas de empeño, que normalmente cobran tasas de interés y tarifas elevadas. Tener una cuenta bancaria y una buena relación bancaria puede calificar a las personas para préstamos con intereses más bajos y otros productos crediticios.

- Acceso limitado a servicios financieros: No estar bancarizado puede resultar en un acceso limitado a ciertos servicios y productos financieros, como cuentas de ahorro, oportunidades de inversión y opciones de seguros. Esta falta de acceso puede obstaculizar la capacidad de las personas para generar riqueza y protegerse financieramente a largo plazo.

- Riesgos de seguridad: Guardar dinero en efectivo en casa puede ser riesgoso, ya que es vulnerable a robo, pérdida o daño. Las cuentas bancarias ofrecen una forma segura de almacenar y acceder a fondos, lo que reduce el riesgo de pérdidas financieras debido a robo o otras circunstancias imprevistas.

Metodología

El análisis fue realizado en abril de 2024 por Comun. Los datos examinan el coste anual de utilizar un servicio como Comun, una cuenta bancaria tradicional., o no estar bancarizado para servicios financieros. En este análisis, analizamos el costo de una cuenta corriente con una institución financiera tradicional, así como el costo de los servicios.fuera de una institución financiera y hizo estas suposiciones:

- Un saldo mínimo para abrir una cuenta

- Costo Comun: $0

- Costo de institución financiera tradicional: $100, esto se basa en el saldo mínimo necesario para poder abrir la cuenta bancaria a la que se hace referencia.

- Costo mensual

- Costo de Comun: $0

- Costo de la institución financiera tradicional: Una tarifa mensual de $12, suponiendo que no se cumpla el saldo mínimo diario de $1,500

- Dos depósitos en efectivo (ATM) por mes

- Costo de Comun: $0 para usar un en-cajero automático de la red y $3.50 por utilizar un socio minorista para realizar un depósito. Comun asumió que un usuario realiza dos depósitos por mes, uno en una tienda minorista y otro en un cajero automático de la red.

- Costo de institución financiera tradicional: $2.50 por un depósito en otra institución financiera y $2.50 si usa un cajero automático fuera de la red. Para la cuenta bancaria analizada en este informe, no hay cargos por depósito en efectivo en sucursales. Sin embargo, este banco cobra $2.50 por depósitos en otros cajeros automáticos. La tienda minorista también le cobrará al cliente, lo que varía según la ubicación, pero Comun asumió $2.50.

- Dos transferencias de remesas por mes

- Costo de Comun: Los clientes pueden enviar su primera remesa sin costo. Después de eso, las remesas conllevan una tarifa desde $2.99.

- Costo de la institución financiera tradicional: $45 para enviar transferencias internacionales en dólares (fuente)

- Para los no bancarizados, Comun asumió que la persona envía remesas con Western Union, lo cual tiene un costo de $8 por transferencia en tarifas fijas si el usuario está depositando efectivo en un punto de Western Union en los Estados Unidos y el destinatario está retirando el dinero en efectivo en un punto de Western Union en México (fuente: calculadora de tarifas). Comun asumió 2 remesas por mes durante un año, y la primera remesa sin costo (una promoción con Western Union).

- Tarifa por cambio de cheques

- Suponemos que un usuario cobra dos cheques al mes y paga $4 cada vez (monto de la tarifa de Walmart).

- Tarifa de giro postal

- Suponemos que un usuario compra dos giros postales al mes y paga $1 cada vez (el monto de la tarifa es de Walmart).

Instant payments

Safe and fast ways to send money without a bank account

8 min de lectura

Did you know it is possible to send money without having a bank account? The lack of access to financial services is a problem that negatively affects the quality of life of thousands of immigrant workers in the United States.

For example, according to a recent survey, the rate of the Latino community in the United States without a bank account dropped from 15% to 10% over the last two years. However, it remains high compared to the national average of 4.5%.

While having a bank account facilitates financial transactions such as transfers, in-store payments, and online purchases, there are now alternatives that allow you to access banking services without needing an account.

Below, you will discover how to transfer money from one card to another without an app or bank account, as well as the safest and simplest methods available to you.

Sending Money Online

Not having a U.S. bank account is not an obstacle to sending money domestically or internationally, as there are methods widely used among immigrant workers who regularly send remittances and conduct other transactions using prepaid cards and cash payments.

International Money Transfer Providers

This is one of the most popular ways to send money without a bank account due to the accessibility, variety of payment methods, and broad coverage typically offered.

International money transfer providers are companies that specialize in facilitating money transfers from one country to another. The key features of these services include:

- Specialization in international money transfers, unlike traditional banks, which have certain limitations, such as high commissions, unfavorable exchange rates, extensive delivery time, and participation of intermediaries that increase costs.

- More affordable fees.

- Various sending methods.

- Multiple Money Transfers Locations

How to Send Money Without a Bank Account Through an International Transfer Platform

Comun allows you to send money to your loved ones for a modest transfer fee starting at USD 2.99 up to the applicable limits. It is very simple; just follow these steps:

1. Open your account with Comun; it will only take a few minutes!

2. Choose the most convenient delivery method for your recipient, such as cash pick up at a physical store like Oxxo, Grupo Elektra, 7 Eleven, and more.

3. You may also send money directly to a bank and have it picked up at one of its branches.

4. Track the delivery directly in your Comun mobile application.

Comun is an excellent option for our community, as it provides Spanish-language service, which is highly appreciated by the immigrant community. Open your account today and start sending money without complications.

What Information Do You Need to Send Money Without a Bank Account?

To send money without a bank account, you only need the following information about your recipient:

- Full name of the recipient, exactly as it appears on their official ID.

- Recipient’s phone number.

- If the transfer is made to a bank account, you will also need:

- Recipient’s address.

- Bank account number, depending on the receiving country.

P2P Services

P2P (peer-to-peer or person-to-person) services allow immediate money transfers between individuals without intermediaries. These options are useful for everyday needs such as paying rent, shared services, splitting transportation costs, and sending money to your relatives in the US or internationally.

How to Send Money Without a Card Using P2P Services

- Choose a reliable provider, such as Cash App or Venmo.

- Enter the recipient’s phone number in the mobile app.

- Confirm the transaction and track it.

Sending Money by Mail

Other alternatives involve sending a cashier’s check, a certified check, or a money order through the postal service.

Cashier’s Check

This type of check is issued with the bank’s funds. The customer must pay in cash or directly from their account, and the check is made payable to the recipient.

Certified Check

This check is issued using the customer’s funds. The issuer must have a bank account so that the bank can verify the availability of funds. The recipient may cash the check directly at a bank branch.

Money Order

Another way to send money without a bank account is by using a money order, which is a type of prepaid payment order. To do so, you will need to:

1. Go to a post office or authorized retailer, such as USPS or Walmart, to purchase a money order.

2. Write the beneficiary’s name in the “pay to the order of” section.

3. Write your name in the “purchaser” section.

4. Sign in the space designated for the purchaser, generally on the front of the document.

5. Keep the receipt with the serial number.

6. Pay the amount to be sent plus applicable service fee.

7. Send the money order via regular or certified mail.

8. Write the recipient’s address in the center of the envelope and the sender’s address in the upper left corner.

9. Purchase a postage stamp at the post office and attach it to the envelope.

10. Drop off the envelope at the post office.

The recipient may cash the money order at an authorized branch upon presenting valid personal identification.

The downside of this alternative is that it takes longer to arrive, as it relies on a traditional mailing method.

Sending Money With Prepaid Load

There are other options available to send money without a bank account, such as prepaid cards and mobile applications.

Reloadable Prepaid Cards

Reloadable prepaid cards function similarly to debit cards, with the main difference being that they are not linked to a bank account. They also allow you to pay for services and make online purchases.

To send money using a prepaid card, you only need to:

1. Identify an international money transfer service that supports prepaid cards, such as Western Union or MoneyGram.

2. Select your preferred provider and choose the prepaid card option on their website.

3. Enter the recipient’s information, making sure it is compatible with the selected platform.

4. Confirm the transfer and pay the amount plus the applicable service fee.

Done! The recipient will receive the money on the prepaid card as if it were a bank transfer.

Mobile Wallets/Applications

Lastly, you may opt for mobile wallets or applications that offer money transfer capabilities. Some examples include Cash App, Venmo, and Remitly, which provide access to an mobile app you can use to send and receive money.

These applications do not require a bank account and are user-friendly. Some also offer physical cards that function similarly to debit cards.

7 Essential Tips for Sending Money Without a Bank Account

1. Verify the Identity and Information of the Recipient

Ensure that the recipient’s information, such as name, account number, or phone number, is entered correctly. Any discrepancies could prevent the recipient from collecting the funds.

2. Compare Fees and Exchange Rates

Each provider has its own rates depending on the receiving country, amount, and exchange rate. Remember, with Comun you do not pay excessive fees, and you ensure your family receives more for less.

3. Know the Sending Limits

Some platforms have sending limits that should be considered before selecting a service. For instance, Western Union has a daily limit of USD 7,499, while Cash App allows up to USD 7,500 per week for verified accounts.

4. Keep All Receipts and Reference Numbers

Even though these methods are secure, it is important to keep receipts and reference numbers in case a clarification or issue arises.

5. Use Reputable and Secure Services

It is essential to ensure that you use a trusted service. Check online reviews and verify that the provider has an official website and/or physical offices.

6. Be Cautious of Scams

Unfortunately, scams are common around financial services. No legitimate institution will request passwords or verification data. Always access official websites. If in doubt, visit an authorized branch.

7. Consider Delivery Time

Most options allow you to complete transfers in minutes, but some may take several days. Consider this before choosing your preferred service.

Frequently Asked Questions

Is it safe to send money without a bank account?

Absolutely. Comun is backed by leading financial institutions to protect your funds up to the applicable limits. Additionally, you can track your transfer directly through the Comun mobile app.

How much does it cost to send money without a bank account?

Comun offers a transfer fee starting at USD 2.99, regardless of the amount you send up to the applicable limits. Your first transfer is commission-free!

How long does it take for the money to arrive?

Cash is typically available within approximately 1 hour at the selected store or bank branch.

What documents do I need to send/receive money without an account?

You need the full name of your recipient, and they must present official identification.

Instant payments

What is Venmo and how does it work? The Ultimate Guide for Immigrants to the United States

8 min de lectura

Have you heard of Venmo? It is a digital payment application that has gained popularity in the United States in recent years. According to recent data, in 2024 the mobile application reached 68.3 million active users, representing an 8.8% increase compared to 2023.

The importance this mobile application has acquired cannot be denied, which is why knowing what Venmo is in the United States can be very useful to send and receive money from family and friends quickly and securely.

As a foreign national living in the U.S., you must ensure that you choose a financial platform that meets your needs for sending money to your home country and making payments with ease.

In this guide, we clarify all your potential questions about how to use Venmo in other languages like Spanish, what it is for, the requirements to open an account, the benefits this mobile app offers, and also its limitations.

What Is Venmo and How Does It Work?

Venmo is a highly popular P2P (peer-to-peer) payment mobile application in the U.S. Its primary purpose is to facilitate the instant transfer of money between friends and family, in addition to allowing users to link bank accounts and cards.

Venmo’s business model is based on charging fees for services such as credit card transactions, instant transfers of money to bank accounts, and transactions using its physical card.

Some of the most common reasons immigrants use Venmo include:

- Paying monthly rent

- Receiving wages from occasional jobs

- Paying or receiving money from friends and family

- Lending or repaying money to acquaintances

Key Features of Venmo: What Can You Do With It in the U.S.?

To fully understand what Venmo is in the United States, it is important to explore the functionalities this P2P payment service offers its users to simplify their lives:

- Instant sending and receiving of money between Venmo users

These are the mobile app’s most important features, as it allows for instant transfers without charging a fee between Venmo users.

It also enables adding notes or emojis to identify each transaction and the option to use the mobile app’s balance or a linked bank account. - Use of Venmo Debit Card (Mastercard) for purchases

Venmo also offers a physical debit card for making purchases at brick-and-mortar establishments. It is valid at any merchant that accepts Mastercard within the United States.

Additionally, it includes an extra benefit: each purchase with the debit card accumulates cash back for greater savings. - Direct deposit for wages and benefits

You can use your Venmo account to receive your salary or other types of transfers. All you need is your personal QR code. - Bank transfers to bank accounts

Venmo offers two types of bank transfers: standard transfers, which are free and take one to three business days, and instant transfers, which incur a fee of approximately 1.75% and are completed within minutes. - Payments to businesses and merchants that accept Venmo

Another advantage of this service is the “Pay with Venmo” feature, which allows payments at physical or online businesses that accept Venmo.

This streamlines transactions and enables you to use the balance deposited in the application directly. - Social features: comments, “likes,” and bill-splitting

Lastly, one feature that makes Venmo more appealing is the ability to add comments, likes, and emojis.

This allows you to request payments from friends and family, add reminders, and split expenses among multiple users. - Business profiles for companies

Venmo allows small businesses and independent workers to create a business profile to receive payments directly into their account via username or QR code.

What Do I Need to Have Venmo? The Reality of Its Availability

Now that you know the benefits of this mobile application in detail, you probably want to learn the requirements to start using it.

Before learning how to pay with Venmo, remember that it only works in the United States.

These are the requirements to use Venmo:

- Have an Android or iOS phone

As it is a mobile application, you must have a compatible Android or iOS smartphone and download the mobile app from the corresponding store. - Register with a personal phone number

To register in the mobile app, you need a U.S. phone number and must reside in the country, as Venmo is only available there. You may also register with an email address. - Link your U.S. bank account

Linking a bank account isn't required to create your Venmo account; you can receive money and pay with your balance or a card. However, most features require a linked bank account. - Link a debit or credit card

Another option to access all Venmo’s features is linking a credit or debit card instead of a bank account. This allows you to use the card’s balance for transactions directly from the mobile app. - Verify your account

Account verification is required to access all Venmo features, to confirm users’ identities. Verified users can send up to $60,000 per week, but only if their SSN or ITIN has been confirmed. Non-verified users can send up to $299.99 per week.

To verify your account, Venmo will request the following:

- Full legal name

- Mailing address in the United States

- Date of birth

- SSN (Social Security Number) or ITIN

How to Transfer Money from Venmo to My Bank Account?

To transfer money from Venmo to your bank account, once it is linked and verified, follow these steps:

1. Log into your account through the mobile app and go to the “Me” tab.

2. Press the “Transfer” or “Add” button.

3. Enter or edit the amount you want to transfer to your bank account.

4. Select the transfer method: “Instant” or “up to 3 biz days,” noting any applicable fees.

5. Confirm the transfer details and complete the process.

If you want more options for depositing money into another person’s account, do not miss these recommendations.

Limitations of Venmo for Immigrants: Why Is It Not a Complete Solution?

The need for immigrants to have an integrated solution allowing access to digital payments, transfers, and other benefits increases daily. Therefore, while Venmo is a popular option for sending and receiving money in the U.S., it may present limitations for immigrants working in the country.

One limiting factor for immigrant communities is the language barrier in customer support. Because it is a service designed for U.S. residents, it is not optimized for people who speak a different language, such as Spanish. In addition, you should have a U.S. bank account.

Your best option may be to entrust your financial assets to a service offered in your language.

Comun: An Excellent Alternative to Venmo for the Immigrant Community in the U.S.

We present Comun, the solution for immigrants seeking to improve the way they send and receive money to family and friends.

Why Is Comun a Great Option for Immigrant Communities in the United States?

- Comun allows you to open an account with the official identification from your country.

- It is also a platform available in Spanish without complicated terms.

- Unlike Venmo, Comun enables you to send remittances to LATAM for an affordable fee starting at $2.99, subject to applicable limits.

- Access a mobile application to perform your transactions from the palm of your hand.

If you think accessing quality financial services in the U.S. is impossible for immigrants, open your Comun account today and forget about complications.

Disclosures:

“Comun is a financial technology company and not a bank. Banking services are provided by Community Federal Savings Bank; Member FDIC. The Comun Visa® Debit Card is issued by Community Federal Savings Bank, pursuant to a license from Visa U.S.A Inc. and may be used everywhere Visa Cards are accepted.”

“Funds in your account are FDIC insured up to $250,000 by ownership category through Community Federal Savings Bank (CFSB), Member FDIC, in the event CFSB fails.”

“A service provided by Service UniTeller, Inc. Service UniTeller, Inc. is licensed in all states that require a license.”

“Remittance fees start at $2.99 but may vary. Please check the app for more details.”

“Comun Inc. may earn revenue from the conversion of foreign currencies.”

“Direct deposit funds are typically available when we receive the payment file, up to two days before the scheduled payment date. This early availability is not guaranteed.”

Comun Busca Ahorrarles a los Latinos Cientos de Dólares en Comisiones de Remesas Introduciendo Transferencias Internacionales Seguras

8 min de lectura

A partir de hoy, todos los clientes de Comun tendrán acceso a transferencias internacionales de dinero sin costo por tiempo limitado. Posteriormente, la tarifa será desde $2,99.

Enviar transferencias internacionales de dinero, también conocidas como remesas, puede resultar costoso, dadas las tarifas adicionales que los consumidores enfrentan por parte de las instituciones financieras y otros proveedores de servicios no bancarios. Esta es un área particularmente relevante para la comunidad latina. Según un informe reciente del Banco Interamericano de Desarrollo, las remesas a América Latina y el Caribe alcanzaron un máximo histórico en 2023, llegando a los 155.000 millones de dólares, un aumento del 9,5% en comparación con 2022 (142.000 millones de dólares). En Comun creemos que el envío de remesas no debería tener un costo elevado. Hoy, nos complace anunciar que todos los clientes de Comun pueden enviar dinero a América Latina sin costo por tiempo limitado. Posteriormente, la tarifa será desde $2,99, más baja que la que ofrecen otros proveedores.

Para poner en perspectiva cuánto pueden ahorrar los latinos en tarifas con transferencias internacionales de dinero, Comun analizó y comparó el costo de utilizar proveedores como Western Union o Remitly versus Comun. Además, queríamos saber cómo interactúan los clientes con la nueva función de transferencia de dinero de Comun, que estuvo disponible en marzo de 2024.

Para el análisis, primero analizamos el número promedio de transferencias de remesas que los clientes de Comun envían mensualmente; en este caso, fueron dos transferencias. Utilizando el conocimiento de los clientes de Comun, el informe analizó los países más comunes a los que los clientes envían dinero. Por último, examinamos cuánto podría ahorrar un consumidor en tarifas de remesas durante un período de uno y cinco años si usara Comun frente a Western Union o Remitly, suponiendo que enviara dos transferencias de dinero cada mes.

Hallazgos clave

- Destinos de envío de dinero de los clientes de Comun: Los clientes de Comun tenían más probabilidades de enviar remesas a México, seguido de Honduras, Guatemala, Colombia y Nicaragua.

- Pagar en persona para enviar dinero internacionalmente puede costar cientos de dólares: Según nuestro análisis, suponiendo que una persona envíe dos remesas al mes y pague en persona (por ejemplo, visitando una ubicación de Western Union), las tarifas pueden ascender a $960. Al utilizar un servicio como Comun, los usuarios pueden ahorrar casi $600 en tarifas durante cinco años. Además, los clientes de Comun tienen la conveniencia de enviar remesas directamente desde sus teléfonos.

- Incluso si los usuarios pueden evitar pagar en persona y desean enviar remesas desde una cuenta bancaria, enviar dinero al extranjero sigue siendo costoso: Nuestro análisis encontró que para los usuarios que desean enviar remesas directamente desde una cuenta bancaria en EE. UU., utilizar un servicio como Comun en lugar de Western Union y Remitly puede ahorrar a los consumidores más de $20 en un año y $120 en cinco años.

| Países con las transferencias de remesas más altas |

|---|

| México |

| Honduras |

| Guatemala |

| Colombia |

| Nicaragua |

| Western Union | Western Union | Remitly | Comun | |

|---|---|---|---|---|

| Método de pago | Paga en persona, recibe en efectivo o en cuenta bancaria | Paga por transferencia bancaria, recibe en efectivo | Paga por transferencia bancaria, recibe en efectivo | Paga por transferencia bancaria, recibe en efectivo |

| Tiempo de entrega | En minutos | 0-4 días hábiles | 3-6 días | En minutos¹ |

| Tarifa variable | $8.00 | $3.99 | $3.99 | desde $2.99 |

| Costo en tarifas durante un año | $192.00 | $95.76 | $95.76 | $71.76 |

| Costo en tarifas durante cinco años | $960.00 | $478.80 | $478.80 | $358.80 |

| Ahorro: Cuánto pueden ahorrar los consumidores enviando remesas con Comun durante un año | $120.24 | $24.00 | $24.00 | -- |

| Ahorro: Cuánto pueden ahorrar los consumidores enviando remesas con Comun en cinco años | $601.20 | $120.00 | $120.00 | -- |

Para obtener más información sobre Comun y su última oferta de remesas junto con una cuenta bancaria y una tarjeta de débito en EE. UU., haga clic aquí.

Metodología

Nuestro análisis incluyó varios puntos de datos como:

- Para determinar los países más comunes a los que los clientes de Comun envían dinero y el número promedio de transferencias cada mes, examinamos el uso del cliente entre el 7 de marzo de 2024 y el 15 de abril de 2024.

- Para comprender cuánto pueden llegar a pagar los clientes por enviar transferencias internacionales de dinero, analizamos las tarifas de Western Union y Remitly. Nuestro análisis examinó cuánto paga un individuo en comisiones de remesas si 1) paga en persona, es decir, si entra a una ubicación de Western Union para enviar una transferencia, y 2) un individuo envía dinero a través de su cuenta bancaria, y el receptor lo recoge en efectivo en su destino.

Un servicio proporcionado por Service UniTeller, Inc. Service UniTeller, Inc. tiene licencia en todos los estados que requieren una licencia.

¹Los tiempos de entrega pueden variar.

²Términos y condiciones aquí. Los términos y Condiciones aplican. Oferta de tiempo limitado. Servicio UniTeller, Inc. tiene licencia en todos los estados que requieren una licencia. Comun, Inc. y/o Servicio UniTeller, Inc. pueden obtener ingresos por la conversión de moneda extranjera. Las tarifas están sujetas a cambios. Servicio UniTeller, Inc. y/o Comun, Inc. se reservan el derecho, en cualquier momento, sin previo aviso, de agregar, modificar o cancelar cualquiera y/o todos los términos de la promoción, o reemplazar, total o parcialmente, la promoción con otra oferta sin responsabilidad alguna para Servicio UniTeller, Inc. y/o Comun, Inc.

International Money Transfers

How to send money via Western Union? Complete guide and key tips

8 min de lectura

Western Union is one of the most recognized remittance services worldwide due to its extensive experience, coverage, and accessibility. Many immigrants choose it to send money to their families from the United States.

If you want to optimize the amount your family receives, it is very important to understand the different sending methods available with Western Union, as well as the fees each method generates.

For this reason, we will explain step by step how to send money through Western Union, including the requirements, different modalities, and the advantages and disadvantages of using this international agency.

What is Western Union and How Does It Work to Send Money?

Western Union is a network specialized in international money transfers, available through a large number of physical locations and online methods. It is an accessible method for sending remittances, as it is not necessary to have a banking account to use its services.

It offers two primary methods for international money transfers: online and in-person at a physical agency.

These are the requirements to send money through Western Union from the United States:

What Is Required to Make a Western Union Money Transfer?

- Be at least 18 years old

- Valid photo identification

- If visiting a Western Union agency in person, you may present your passport and, in some cases, your driver's license.

- If using the westernunion.com process, you must upload a photo of your ID and possibly a selfie or other identity verification requirements.

- Recipient’s information

- Ensure that you have the complete and correct details of the person receiving the money:

- Full name (as it appears on their identification)

- Recipient’s country and city

- Delivery method (cash pickup, bank deposit, or other)

- Payment method (card, bank account, or cash)

- Ensure that you have the complete and correct details of the person receiving the money:

Comparison Between Western Union and Comun

| Platform | Fee | Exchange rate (USD - MXN) | You Pay | Estimated Amount Received |

|---|---|---|---|---|

| Western Union | $4.99 - 15 USD | 1 USD = 16.70 MXN* | 300 USD + fee | 4,900 - 5,010 MXN |

| Comun | From 2.99 USD, up to applicable limits | 1 USD = 17 MXN* | 300 USD + fee | 5,100 MXN |

*please note the exchane rate is subject to change at anytime.

In addition to offering more favorable fees and exchange rates for international money transfers, Comun lets you send money 365 days a year digitally from your home, including holidays, which can be affected by longer wait times due to increased customer volume.

Steps to Send Money Through Western Union: Online and In Person

Currently, Western Union allows you to make international money transfers from the U.S. through its website, mobile app, or in person.

Sending Money Online with Western Union

If you prefer to send money online through Western Union, simply follow these steps:

Log in or register on their platform

To open an account with Western Union, you must have the previously mentioned documents and complete the identity verification process.

Then, log in to the Western Union app or website.

Select destination country and amount

With Western Union, you can choose from a wide variety of destinations in Latin America and worldwide, including Mexico, the Dominican Republic, Colombia, Argentina, and others.

Choose payment method

Western Union offers various payment methods such as credit card, debit card, bank deposit, and cash payment.

Enter recipient information

Make sure to enter the recipient’s details correctly.

Confirm and obtain the tracking number (MTCN)

Once all information is entered, verify its accuracy and confirm the transaction. You will then receive a tracking number to monitor the transfer.

Sending Money to a Western Union Agency

If you prefer to send money in person, follow these steps:

Locate a nearby agency

To find the agency closest to your home, visit the website and select the “Find Location” option. Enter your ZIP code and review the available locations.

You may also call Western Union customer service at 1-800-325-6000 for more information.

Fill out the sending form

Go to the service counter and request the sending form, which you must fill out using the same details required for the online form.

Submit payment and fees to the agent

Once the form is filled out correctly, pay the agent the total amount plus the applicable fee.

Receive the tracking number (MTCN)

Finally, receive the tracking number and share it with the recipient so they can collect the money correctly.

Advantages and Disadvantages of Using Western Union for Remittances

Western Union is a popular option for sending remittances securely and quickly, used by thousands of immigrants in the United States every month.

Below are the main advantages and disadvantages of sending money with Western Union.

Advantages

Extensive global coverage and physical presence

Western Union allows you to send money to almost any part of the world, with approximately 500,000 agencies across more than 200 countries. It even offers transfers to rural and hard-to-reach areas.

Fast cash transfers

If you need to send money urgently, Western Union offers a cash pickup option, available within minutes.

Brand recognition and established history

With over a century of experience, Western Union has a strong reputation and proven security in money transfers through its global network.

Disadvantages

High fees

Generally, the smaller the amount sent, the higher the fee. Fees vary depending on the payment and delivery method and typically range between $4.99 and $15 USD, excluding currency conversion.

Uncompetitive exchange rate

In addition to the initial fee, you must account for the loss due to currency exchange, which is calculated using a less competitive margin than the market rate. As a result, your family receives less money compared to other options.

Sending limits

For unverified users, the sending limit is $3,000 USD per transaction. For verified accounts, the limit is $50,000 USD.

Lack of transparency in fee structure

Western Union’s fees are variable and depend on multiple factors such as the destination country, payment method, delivery method, and transfer amount.

Comun: A Fast, Transparent, and Affordable Alternative to Send Money to Your Family

There is no doubt that Western Union is one of the most well-established remittance services due to its long history and ease of access. However, it is important for users to choose the option that best fits their needs.

Before making a money transfer, it is essential to clearly understand all fees and additional costs; otherwise, your family may receive less money without prior notice.

Comun is the comprehensive solution that makes sending remittances easier and more affordable.

Additionally, it offers:

- A mobile app also available in Spanish that allows you to send money easily to more than 17 countries in Latin America.

- Your first money transfer is free, and afterward, you pay a fee starting at $2.99 USD per transfer, up to the applicable limits.

- You need a mobile device to open your account, an official identification from your country (passport, consular ID, driver’s license, among others), and a US residential address.

- 24/7 customer support available in Spanish.

- High security standards that help your money arrive safely and track your transfer in real time.

- Transparent remittance fees.

Open your Comun account today.

Frequently Asked Questions

If you still have questions about how Western Union works, review our FAQ section:

Can I send money to myself through Western Union?

Yes, if you are traveling to another country and do not have a banking account, you can send money to yourself.

Why can’t I send money through Western Union?

There may be several reasons, such as exceeding the sending limit, rejected payment method, or incorrect recipient information.

How much does Western Union charge to send money?

Transfer fees depend on the recipient country, the amount, payment method, and delivery method.

International Money Transfers

How to make an international money transfer? Costs, times and requirements

8 min de lectura

For immigrants in the United States, sending money to their home countries regularly is essential. Therefore, it is important to have access to affordable and accessible financial services.

If you want to know how to make an international money transfer, it is crucial to first compare the different providers of this service and choose the one that offers the most advantages for you and your family.

Comun stands out as a popular option among immigrants because it allows them to send money abroad from the United States, offering advantages in terms of cost, speed, and other key factors.

Below, we provide a comparison table that includes Comun and traditional financial institutions in the United States, such as Bank of America and Wells Fargo:

| Comun | Traditional Financial Institutions | |

|---|---|---|

| Fee | Transfer fee starting at 2.99 USD up to applicable limits | From 10 to 45 USD, depending on the bank |

| Intermediary fees | $0 USD | May generate extra fees from intermediary banks |

| Exchange rate | Competitive | Higher margin than official |

| Speed | Instant to a few minutes (average 8) | From 1 to 5 business days |

| Estimated total fee | 2.99 USD transfer fee + exchange rate, with no extra charges (The first transfer has no fee. Subsequent transfers have a fee starting at $2.99 USD, up to the applicable limit. ATM or intermediary charges may apply; check the app for more details). | From 20 to 60 USD, due to fees and less favorable exchange rates |

How Does an International Money Transfer Work?

The first point to understand is the types of bank transfers available, as this determines the final cost of sending an international money transfer.

In the United States, there are two types of international money transfers: through traditional banks or through specialized services for sending money abroad.

International Money Transfers via Traditional Banks

- Supported by official U.S. financial institutions and security measures, including:

- Identity verification (KYC/CIP) and ongoing AML monitoring (BSA).

- OFAC sanctions screening for senders and recipients.

- Consumer protections for remittances under Regulation E (pre-transfer disclosures, cancellation rights, and error resolution).

- Network and messaging security standards (e.g., SWIFT Customer Security Program).

- Multi-factor authentication and encryption for online banking access.

- A U.S. bank account is mandatory

- Operates through the SWIFT code

- Generates higher fees due to intermediaries

- Transfer time may take up to 5 business days

International Transfers via Specialized Applications

- Operates through digital networks connected with banks or physical branches in each recipient country

- Lower fees, as they do not use intermediaries and offer more competitive exchange rates

- Money transfers are completed within minutes or hours

- A U.S. bank account is not mandatory to use these services

Before paying unnecessary fees, make sure to choose the best international money transfer provider and make the most of your money.

Steps and Requirements for Making an International Money Transfer

Below, we outline what is needed to easily make an international bank transfer from the United States, whether you choose a traditional bank or a specialized application for this type of service:

1. Choose a Provider

Some of the traditional banks you can use are Chase, Bank of America, Capital Bank, Citibank, and Wells Fargo. If you don't have a US bank account, you'll need to make sure you have the necessary requirements to open an account, such as a Social Security Number (SSN). For the aforementioned banks, you can present an ITIN instead, along with a government-issued ID.

Another factor to consider is how long an international money transfer takes, as traditional banks usually take longer due to intermediaries involved in the process.

If you prefer a specialized application for international money transfers due to the flexibility they offer compared to banks, an excellent alternative is Comun, which allows you to transfer money from your phone without complications or intermediaries.

2. Create an Account

General Requirements for Opening an Account at a U.S. Bank

- Valid passport or immigration document

- Social Security Number (SSN)

- Individual Taxpayer Identification Number (ITIN)

- Proof of address in the United States

- Some banks require an initial deposit of approximately $25 USD

Depending on the bank, you may open the account online or by visiting a branch for data verification.

Requirements for Opening an Account with Comun

- Mobile phone compatible with Android or iOS

- Email address

- Official foreign identification

- Have a US residential address

In both cases, you will have access to a debit card and a mobile application that will allow you to make international money transfers and other transactions from the palm of your hand.

3. Enter Transaction Details

Once you activate your account, enter the information required for an international money transfer:

- Full name of your recipient, as it appears on their official ID

- Recipient’s phone number

- Recipient’s address (only if sending money to a bank account)

- Recipient’s account number (only if sending money to a bank account)

- SWIFT code (if transferring through a traditional bank)

Then, enter the amount you wish to send.

Comun and other specialized applications also allow cash pickup at physical locations, so your recipient does not need a bank account.

4. Review Costs and Rates

Next, review the international money transfer fees as well as the exchange rate, as these will impact the final amount your recipient receives.

The cost of an international money transfer depends on several factors, which we detail below.

5. Send the Money

Once you confirm that the information entered is correct, authorize the transfer, including any additional fees.

Comun allows you to track your transfers through its application, whether you choose to send money to a bank account or opt for cash pickup at a physical location.

Remember that transfer speed depends on the platform, and traditional banks can take up to 5 business days to complete these transactions.

6. Confirm Receipt

Finally, confirm with your recipient that the transfer was received within the stipulated timeframe. You can generate a transaction receipt directly in the mobile application.

Everything About the Cost of Sending Money Abroad from the U.S.

International money transfers are a common practice among immigrants in the United States.

That is why it is essential to detail the factors that influence the cost of transfers, as well as the best options for sending remittances to your family quickly and without complications.

These are the main factors to consider when calculating the cost of your international money transfers:

- Transfer Fees

International transfers incur a fee, which varies depending on the platform, whether it's a traditional bank or a specialized app.

Another factor that affects the fee level is the method used to send the money. The price can vary depending on whether the transaction is made through a website, an app, or at a physical branch.

International money transfer fees at traditional banks vary depending on the financial institution. Here are some examples:

- Bank of America: $45 USD

- Wells Fargo: from $25 to $40 USD

- Citibank: from $25 to $35 USD

- Truist Bank: $65 USD

On the other hand, some mobile applications offer international money transfer options for less than $3 USD, which is much more beneficial for the economy of foreign workers.

- Exchange Rate

The exchange rate also significantly impacts the final amount your recipient receives. It refers to the value applied by the platform when converting the dollar amount to the local currency.

Traditional banks generally use a lower rate than the official rate. For example, if the Mexican peso is officially 18.00, banks might apply approximately 17.20 MXN.

This means that if you send $300 USD, your recipient could receive about $13 less (240 MXN less), not counting the bank fees, which make the cost even higher.

- Hidden Fees

In addition to international money transfer fees, traditional banks may charge additional fees if intermediary banks are involved in processing the transfer.

We recommend checking all costs involved and choosing a competitive option that does not reduce the total amount your family will receive.

Comun is an excellent alternative for making international money transfers, as your first transfer fee is waived, and subsequent transfers have a fee starting at $2.99 USD per transfer, up to applicable limits, with no hidden fees or intermediaries.

Review our comparison table between traditional banks and Comun at the beginning of this article, and choose the best option for your money.

Want to Make Secure International Money Transfers? Do It Easily with Comun

In this article, we presented how to make an international money transfer from the United States through traditional banks or specialized applications such as Comun, an excellent choice for immigrants.

Comun is the solution for bringing immigrant families closer together through affordable and low-cost remittances.

Why Choose Comun for International Money Transfers?

- Easily open your account with official documentation from your country

- Send money to your family with a transfer fee starting at $2.99 USD, up to the applicable limits.

- Your money will arrive within minutes

- Access a mobile application and Visa debit card for better control of your finances

Discover an easy and fast way to access the financial services you deserve. Open your account with Comun and forget about complications.

International Money Transfers

What banks does Zelle have in Mexico? A Complete Guide to Sending and Receiving Money from the U.S.

8 min de lectura

Have you heard of Zelle? It is a highly popular digital payments platform in the United States. It allows users with accounts at affiliated banks—whether traditional banks, digital banks, or credit unions to easily send and receive money.

In 2024 alone, Zelle reported 151 million enrolled accounts, including individuals and small businesses, reflecting its widespread adoption among U.S. users.

If you need to send money outside the United States easily, for example Mexico, you may be wondering which banks in Mexico support Zelle.

However, this platform does not have agreements with any banks in Mexico, and it is mandatory to have a U.S. banking account to access its services.

Nevertheless, there are other options as efficient as Zelle for sending money to Mexico, such as banking accounts with integrated remittance services and international money transfer applications.

Below, we explain how to receive money through Zelle, the benefits it offers for users in the United States, and the alternatives available for sending money to other countries.

What is Zelle and Is It Possible to Use It in Mexico?

Zelle is a digital payments service that facilitates P2P (peer-to-peer) transfers at certain partner banks within the United States.

It is known for being a fast service, with money transfers reflected within minutes, in addition to being free and having broad coverage throughout the U.S.

It operates through the mobile apps of participating banks, as it is directly integrated with them and only allows money transfers to other Zelle users.

But which bank in Mexico is compatible with Zelle? Unfortunately, it is not possible to send or receive money through this platform in Mexico, as it is not designed for international money transfers and only complies with the technological and regulatory standards of the U.S. financial system.

Which Banks in Mexico Use Zelle? Everything You Need to Know

No bank in Mexico is compatible with Zelle services, meaning that international money transfers cannot be made through this platform.

To use Zelle, you must have a U.S. banking account at one of the affiliated banks.

Here is a list of some of the major banks that support Zelle in the United States:

- Ally Bank

- Bank of America

- BMO Harris Bank

- Capital One

- Chase (JPMorgan Chase)

- Citibank

- Citizens Bank

- Discover Bank

- Fifth Third Bank

- FirstBank

- Frost Bank

- Huntington Bank

- PNC Bank

- Regions Bank

- TD Bank

- Truist Bank

- US Bank

- Wells Fargo

Although Comun is not integrated with Zelle, this does not limit its functionality, as it is a comprehensive personal finance solution that goes beyond just money transfers.

How to Send Money to Mexico with Zelle? Answers and Efficient Alternatives

If you need to send money to Mexico quickly, you will have to choose a different service than Zelle, as it only allows bank transfers between U.S. accounts.

The main reasons Zelle is not available in Mexico are:

- To register with Zelle, you must access the online banking platform of one of the affiliated U.S. banks.

- You also need a U.S. phone number or email address.

- Zelle is not a remittance or international payment platform, so it does not have the capacity to convert currencies or deposit funds in international banks.

- Zelle does not comply with the regulations of financial institutions in Mexico, such as Banxico and the CNBV.

If you have used Zelle to send money within the United States, you are likely looking for a similarly reliable system to make international money transfers.

U.S. Banking Accounts with Integrated Remittance Services

In addition to traditional banks, there are alternatives that offer integrated remittance services to facilitate money transfers to Mexico.

Comun is a platform that meets the needs of many people in the United States, especially the immigrant community, by allowing remittances to be sent to loved ones easily, at very low cost, and through a single mobile application.

International Money Transfer Platforms

Another alternative for making international money transfers is to use platforms specialized in this type of transaction.

Examples include:

- Wise: sends money between accounts using the real time exchange rate.

- Remitly: offers international money transfers with standard or instant delivery.

The advantage of these platforms is that a bank account is not required, and their operation is accessible. However, the money transfer fees vary depending on factors such as the amount to be sent and the exchange rate.

Traditional International Bank Transfers to Mexico

You can also opt to make money transfers through traditional banks, for which you will need the SWIFT code of the receiving institution in Mexico and the recipient’s banking details.

Although it is a secure option, it is also one of the most expensive, due to high fees and intermediaries that increase the cost.

For example, a U.S. bank like Bank of America charges a $45 USD fee plus an average of 1% to 3% exchange rate margin. Therefore, in a money transfer of $1000 USD, the recipient receives approximately 900 pesos MXN less than with specialized international money transfer platforms.

Cash Deposit/Withdrawal Services at Retail Networks

If the recipient does not have access to a banking account, you can choose a service for cash deposit and withdrawal at physical locations.

Some examples include:

- Western Union: global network for bank transfers and cash delivery

- MoneyGram: allows money transfers to banking accounts and in cash

- Comun: also allows quick cash transfers

Beyond Zelle: Comun Simplifies Your Financial Life in the U.S. and Your Money Transfers to Mexico

Although Zelle is a very effective service for sending and receiving money within the United States, it has limitations that prevent international money transfers, making it more suitable for citizens who need to make frequent payments within U.S. territory.

For the immigrant community in the United States, it is important to choose a solution that not only facilitates money transfers but also offers a complete, accessible, and easy-to-use finance platform.

Comun is the platform that will simplify your financial life in the United States, offering the following benefits:

- Open an account easily using your official ID from your country.

- Forget about traditional fees: no opening fee, no monthly maintenance fee, and no minimum balance required.

- No hidden charges for remittances: your first international money transfer is free, and afterward you pay a fee starting at $2.99 USD per transfer, up to the applicable limits.

- Customer support also available in Spanish.

- Integrate your finances and remittance service in a single mobile application, making Comun the most suitable option.

- Obtain a Visa debit card to make purchases in physical stores.

- Access an extensive cash management network and make deposits at thousands of locations near you.

Open your Comun account and access a financial service without complications.

Frequently Asked Questions

Do I need a U.S. account to use Zelle?

Yes, Zelle is only available through the online banking platforms of affiliated U.S. banks.

Can I send money to Mexico via Zelle if I have a U.S. account?

No, no bank in Mexico is compatible with Zelle.

What are the best alternatives to Zelle for sending money to Mexico?

Comun: a fintech platform that provides access to an account and remittance capabilities.

Does Comun offer Zelle for sending money to Mexico?

Comun is not connected to Zelle, but you can send money to Mexico for a fee starting at $2.99 USD per transfer up to the applicable limits.

How do I set Zelle to Spanish?

Since it is a service available through the affiliated bank apps, you must access their settings and select Spanish as the preferred language.

How do I download Zelle?

Go to the Play Store or App Store and search for Zelle. Remember, it is only available in the United States.

Financial Education

What is the best app to transfer money? Find the one that's right for you.

8 min de lectura

Nowadays, sending and receiving money through applications is essential to daily life, whether to receive a fixed salary, pay for services, or send money to friends and family.

Discover the best apps to send money quickly, securely, and affordably, both within and outside the United States.

Below you will find an overview of various money transfer apps, their features, and benefits, so you can choose the one that best fits your lifestyle.

There are several apps available for sending money within the United States and internationally. Before choosing one, it is important to understand their advantages and disadvantages.

Comparison of the Best Money Transfer Apps**

| Name | Cost per transfer | Speed | Transfer limits | Additional features | Coverage |

|---|---|---|---|---|---|

| Venmo | Free or 3% if using credit card | Up to 1 day | Up to $299.99/week (unverified) Up to $60,000/week (verified with SSN or ITIN) |

Works as a social payment network. Online and in-store purchases. | U.S. |

| Zelle | Free (some banks may apply fees) | Minutes | Approx. $500/day (varies by bank) | Integrated into most U.S. banks | U.S. |

| Cash App | Free or up to 1.75% for instant transfers | Up to 2 days | Up to $7,500/week (verified) | Free debit card (Cash Card) | U.S. |

| Comun | Free in the U.S. or starting at $2.99 for international transfers | Instant or within minutes (average 8) | Up to $9,999/month* | Allows account opening with official ID, no SSN/ITIN required | U.S. and Latin America |

| Western Union | Between $3 and $30 (depending on amount, country, and method) | Immediate to several days | Up to $5,000 online | Cash transfers and withdrawals with broad coverage | 200+ countries |

| Remitly | Up to $10 (depending on speed) | Up to 5 days | From $3,000/month (depending on verification) | Home delivery option | 100+ countries |

| Wise | Variable fee (exchange rate and amount) | Up to 2 days | Up to $5,000/month | Multi-currency account | 70+ countries |

| Revolut | Free between Revolut users or ~5% for international transfers | Up to 2 days | Depends on country and currency | Automatic savings and financial analytics | U.S., Europe, LATAM, Asia |

| PayPal | Free local / ~3.95% + fixed fee for international transfers | Up to 1 day | Up to $10,000 per transfer (verified accounts) | Allows linking multiple payment methods and receiving money | 200+ countries |

**Please check each provider for their most up to date information.

As you can see, there are a wide variety of apps for sending money free or with affordable fees. Below, we provide detailed explanations of their features.

3 Best Apps for Sending Money in the United States

If you are looking for apps to send money within the United States, we present three options with various benefits for all types of users.

Venmo

This is a payment transfer app that operates within the United States. In addition to facilitating transactions between relatives, friends, and businesses, it functions as a kind of social network, where users can share and comment on their payments to connect and build community.

Operational Features and Functions of Venmo

Payment methods: Users can link a bank account to make payments using a debit or credit card.

Transfer speed: ACH transfers take approximately one day, though they may take longer in some cases.

Transfer limit: Up to $60,000 per week for verified users.

Additional services: Functions as a social payment network. Allows online and in-store purchases.

Advantages of Venmo

- Intuitive and easy-to-use interface

- Instant transfers between Venmo accounts

- Ability to transfer money to other bank accounts

Disadvantages of Venmo

- Security risks

- Not suitable for international transfers

- Lack of privacy, meaning your transactions and comments can be seen by others if you don't adjust your preferences.

Zelle

Zelle is a service that allows money transfers between bank accounts compatible with the Zelle network. It is directly integrated into most bank apps and websites, requiring only the recipient’s email or phone number to send money.

Operational Features and Functions of Zelle

- Payment methods: Operates through banks that offer the Zelle service.

- Transfer speed: Immediate.

- Transfer limit: Varies by bank, approximately $500 per day.

- Additional services: Integrated into most U.S. banks for easy account-to-account transfers.

Advantages of Zelle

- Fast and free service

- No need for recipient’s bank details

- No limits on receiving money

Disadvantages of Zelle

- No standalone app

- Not supported by all banks

- Only works within the United States

Cash App

Cash App is an application for sending, receiving, and saving money. It's also easy to shop online and make payments between friends.

Operational Features and Functions of Cash App

- Payment methods: Cash Card debit card.

- Transfer speed: Standard transfers take up to three days, or immediate transfers with fees.

- Transfer limit: Up to $7,500 per week for verified users.

- Additional services: Access to Cash Card, a free debit card linked to your app balance.

Advantages of Cash App

- Security measures to protect user data

- Available debit card

- Ability to send and receive money via Cashtag, QR code, email, or phone number

Disadvantages of Cash App

- Not compatible with international transfers

- Fees for credit card usage

4 Best Apps for Sending Money Internationally

The services mentioned above are suitable for domestic transfers within the United States. If you intend to send money internationally, consider the following alternatives.

Comun

Comun is a digital platform that allows users to send and receive money between accounts. It is an excellent option for our community, offering services available in Spanish and enabling both domestic transactions and international remittances. It also features competitive pricing for users seeking accessible solutions.

Operational Features and Functions of Comun

- Payment methods: Comun account and direct deposits.

- Transfer speed: within minutes (less than 30 minutes).

- International transfer limits*: Comun uses cumulative limits:

- 1 day: $2,999

- 7 days: $4,999

- 14 days: $7,999

- 30 days: $9,999

- 60 days: $11,999

- 90 days: $19,999

- Amounts sent are aggregated within each time window. For example, if you send $2,999 today, you may only send an additional $2,000 in the next six days until you reach the $4,999 limit for seven days.

- Additional services: Ability to open an account with the official ID from your country.

Advantages of Comun

- Enables money transfers without complications

- Maximizes every dollar so your loved ones receive more

- Allows account opening with the official ID from your country

Disadvantages of Comun

- The recipient must have a Comun account for domestic transfers, but only needs name, phone number, and date of birth to receive money.

MoneyGram

MoneyGram is a platform that enables international money transfers via website, mobile app, or physical retail locations.

Operational Features and Functions of MoneyGram

- Payment methods: Cash, card, bank account, and online banking.

- Transfer speed: Up to one day.

- Transfer limit: Up to $10,000 online.

- Additional services: Bill payments and other international services.

Advantages of MoneyGram

- Global coverage

- Available at numerous retail locations

Disadvantages of MoneyGram

- Unfavorable exchange rates for the user

- High transaction fees

Western Union

Western Union is a global money transfer network operating in over 200 countries. It offers various receipt methods, including bank deposit, cash pickup, and digital wallets.

Operational Features and Functions of Western Union

- Payment methods: Cash, card, bank account, and online banking.

- Transfer speed: Minutes to several days, depending on the delivery method.

- Transfer limit: Up to $5,000 online.

- Additional services: Broad global presence.

Advantages of Western Union

- Presence in over 200 countries

- Cash pickup option

Disadvantages of Western Union

- High transfer fees

- Unfavorable exchange rates

Remitly

Remitly is an international money transfer service operating in more than 170 countries.

Operational Features and Functions of Remitly

- Payment methods: Bank account, debit card, and credit card.

- Transfer speed: Express transfer is immediate; Economy transfer can take up to 5 days.

- Transfer limit: Depends on verification level. For example, a new user has a $3,000 monthly limit for transfers to Mexico.

- Additional services: Home delivery option.

Advantages of Remitly

- Multiple delivery methods available

- Affordable fees

Disadvantages of Remitly

- Higher fees for express transfers

- Limited availability in certain regions